Form 730 - If you are in the business of accepting wagers or. 80 or more passive income will not be.

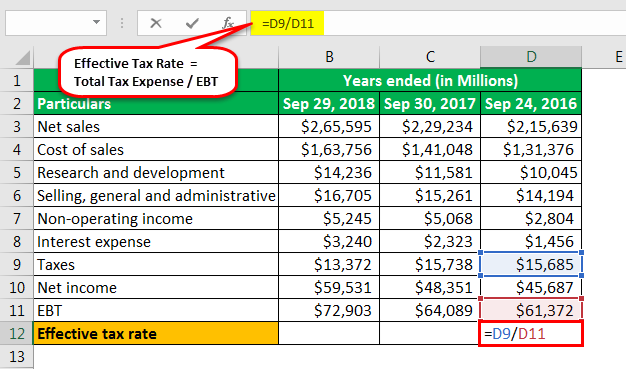

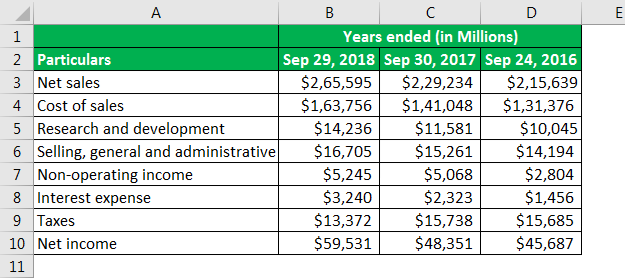

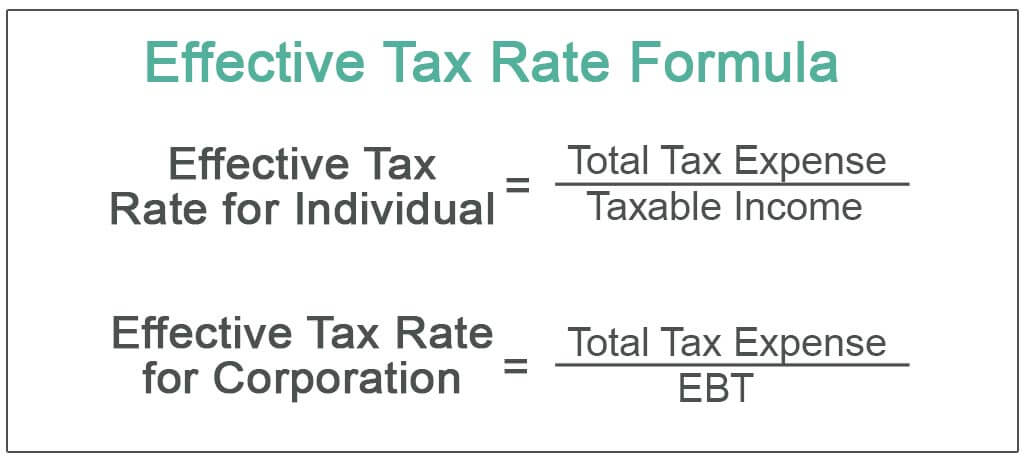

Effective Tax Rate Definition Formula How To Calculate

Entity type Tax rate.

. Corporate Tax Rates 2014-2018. Base rate entity company tax rate. Due to a provision in the recently enacted.

It also eliminates the corporate alternative minimum tax. Albania 15 15 15 15 15 Algeria 25 23 26 26 26 Andorra 10 10 10 10 10 Angola 35 30 30 30 30 Anguilla 0 0 0 0 0 Antigua Barbuda 25 25 25 25 25 Argentina 35 35 35 35 3035 Armenia 20 20 20 20 20 Aruba 28. Blended Tax Rates for Corporations.

Not-for-profit companies with a taxable income above 915 are taxed on all of their taxable income. Corporate income tax rate from a maximum of 35 to a flat rate of 21. 2018 Corporate Tax Rates Tax Reform eliminated the numerous tax brackets for corporations and instead imposed instead a tax rate of 21 tax on C-corp income.

Visualize trends in state federal minimum wage unemployment household earnings more. Select link here for the updated Cannabis Tax Rate Table. However businesses pay different amounts in taxes based on their entities.

Report the tax on Form 2290For additional information see the instructions for Form 2290. Not-for-profit companies with a taxable income of between 417 and 915 are taxed on their taxable income above 416. The carrying on a business test is replaced with a passive income test under which companies that are generating predominantly ie.

Tax Rate Profit Threshold. Six states Alaska Illinois Iowa Minnesota New Jersey and Pennsylvania levy top marginal corporate income tax rates of 9 percent or higher. Year Assessment 2017 - 2018.

37 rows On Jan. Rates range from 3 percent in North Carolina to 12 percent in Iowa. The tax applies to vehicles having a taxable gross weight of 55000 pounds or more.

Likewise people ask what is the small business tax rate for 2018. Headquarters of Inland Revenue Board Of Malaysia. This rate applies to corporations whose tax year began after Jan.

2018 Tax Rate Tables Current for 2022 2018 Non-Gross Tax Rate Tables Current for 2022 2018 Tax Rate Table Cannabis Businesses. The Treasury Laws Amendment Enterprise Tax Plan Base Rate Entities Bill 2018 now law provides a bright line test for corporate tax entities to qualify for the lower corporate tax rate. Under the TCJA AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold.

Supplemental Net Income Tax all corporations financial institutions until 1989. Please note that if you operate a cannabis business Classification L050 expired on 123117. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

These table do not include dividend or long term capital gains rates. Alternative Minimum Tax AMT rate. Federal and State Business Income Tax Rates The federal corporate tax rate was reduced from a stepped rate up to 35 to one flat rate of 21 effective with the 2018 tax year and beyond.

Company with paid up capital not more than RM25 million. On average the effective small business tax rate is 198. 1 2018 the corporate tax rate was changed from a tiered structure that staggered.

Subsequently on November 7 2017 they passed Bill 84 pdf which sets the general corporate income tax rate at 12 effective January 1 2018 increases the small business threshold from 500000 to 600000 effective January 1 2018 and sets the. 43 rows Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Profits from 000.

And the tax rate your business will face largely depends on which state you operate in. To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. In 2018 the 28 percent AMT rate applies to excess AMTI of 191500 for all married taxpayers 95750 for unmarried individuals. The Tax Cuts and Jobs Act TCJAwhich first took effect for the 2018 tax yearreduced the US.

Generally sole proprietorships pay a 133 tax rate small partnerships pay a 236 tax rate and small S-corporations face a 269 tax rate. Ad Explore detailed reporting on the Economy in America from USAFacts. Therefore no matter how much income your C-corporation makes this means you wont pay more than a 21 rate on income.

United Kingdom Corporation Tax Rate in 2018. These companies are being referred to as pass-throughs because expenses and revenues for these organizations are passed through to the owners personal tax returns at individual rates. 10 rows 2018 Fiscal Year.

From the 202122 income year companies that are base. When you take this into account the nations overall statutory corporate income tax rate including average state corporate income taxes is back up to 257 percent. 2 Corporate tax rates also apply to LLCs who have elected to be taxed as corporations.

These tables do not include employment taxes such as Medicare and Social Security taxes. Tax rate by entity. Historical Tax Rates in California Cities Counties.

Corporate companies are taxed at the rate of 24. Jurisdiction 2014 2015 2016 2017 2018. Ad Save time and increase accuracy over manual or disparate tax compliance systems.

Personal service corporations pay tax on their entire taxable income at the rate of 35. Non-Gross Receipts Business Tax Rate Table. Tax Rate of Company.

Corporations other than banks and financials. Beginning with the 2018 tax year the TCJA makes the corporate tax rate a flat 21. Form 2290 - There is a federal excise tax on certain trucks truck tractors and buses used on public highways.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. State Corporate Income Tax Rates and Brackets for 2018 Key Findings Forty-four states levy a corporate income tax.

How The Tcja Tax Law Affects Your Personal Finances

Government Revenue Taxes Are The Price We Pay For Government

Effective Tax Rate Definition Formula How To Calculate

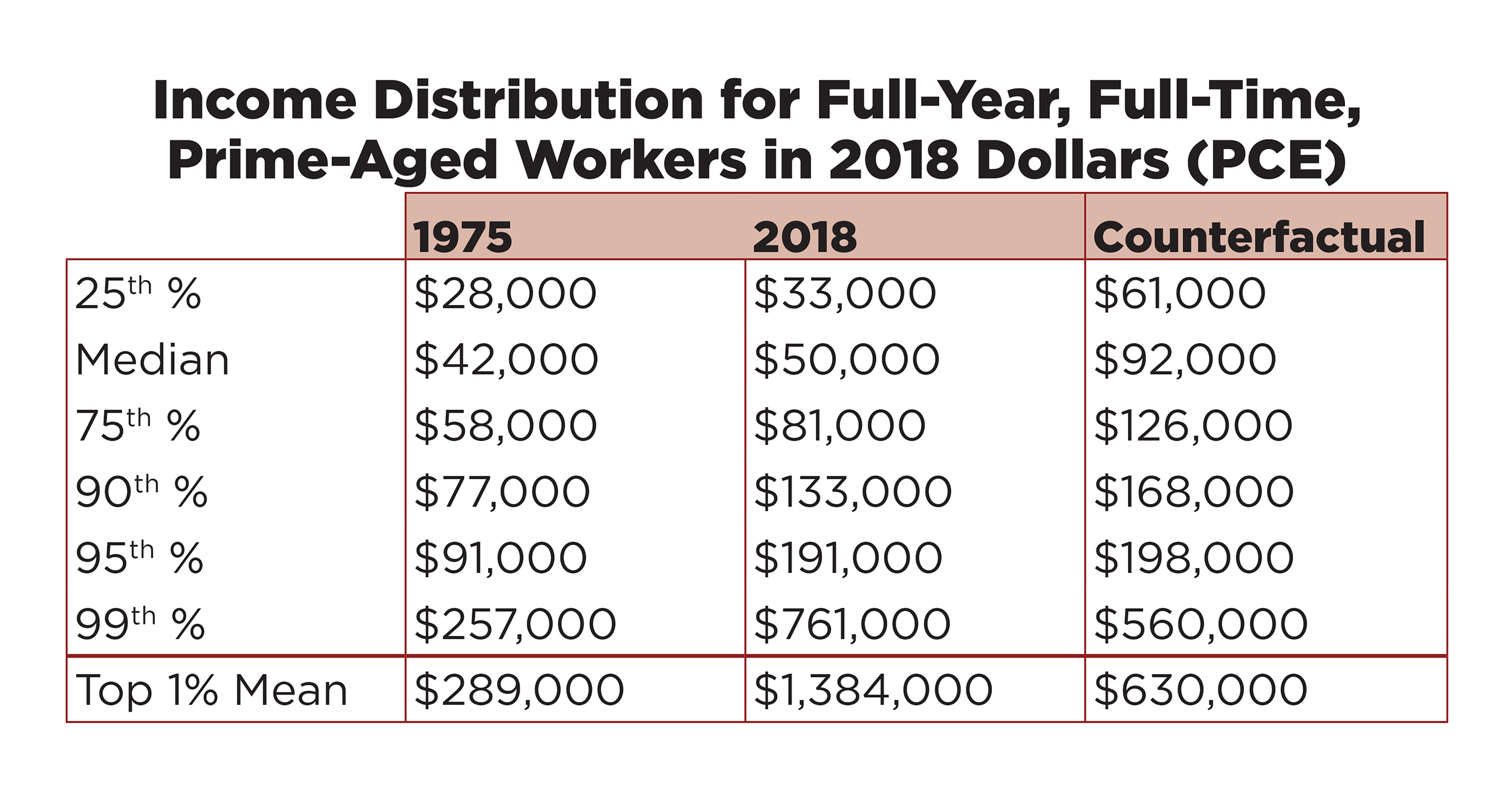

Inequality And Taxes Inequality Org

Sources Of Personal Income In The United States Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Much Does A Small Business Pay In Taxes

Government Revenue Taxes Are The Price We Pay For Government

Certainty For Company Tax Rate Reduction Lexology

Effective Tax Rate Definition Formula How To Calculate

Weighted Average Cost Of Capital Wacc Formula Calculation Example

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Average U S Income Tax Rate By Income Percentile 2019 Statista

Cell Phone Tax Wireless Taxes Fees Tax Foundation

America S 1 Has Taken 50 Trillion From The Bottom 90 Time

State Corporate Income Tax Rates And Brackets Tax Foundation

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)